It’s amazing to consider the possibility of having a credit card that provides cash-back rewards without any annual fees, and this is actually a reality! With this particular card type, customers can enjoy an attractive financial advantage when they use the card for their purchases.

Essentially, they can receive a refund based on the percentage of the purchase they make and the bank’s rates. This is an excellent way for customers to save money while still spending, enjoying the convenience and flexibility of using a credit card.

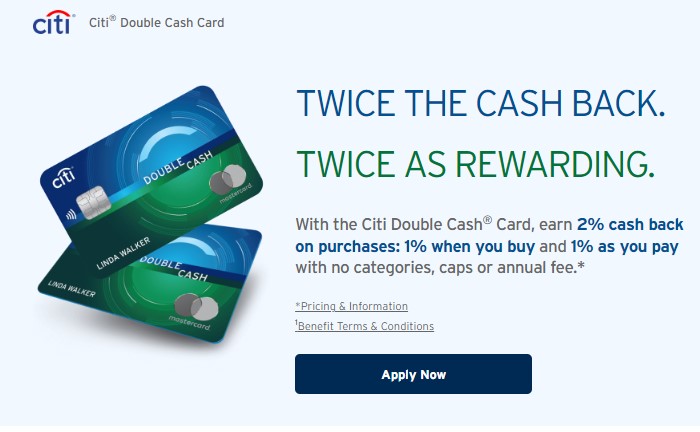

After thoroughly comparing various banks and their credit cards, we have concluded that the Citi® Double Cash Card is the best option for those seeking a high cash-back credit card with no annual fee. This card offers a generous 1% cash back on all purchases, but the benefits do not stop there.

In addition, the cardholder will receive an additional 1% cash back when the bill is paid in full, resulting in a total of 2% cash back on all purchases. Citi credit card is highly advantageous for those looking to earn cash-back rewards without paying an annual fee.

Earn easy money with your Citi Double Cash® Card

Use the Citi Double Cash® Card to earn ThankYou® Points as cash back. You’ll receive one point toward your rewards for every dollar spent on your purchases. In addition, you’ll make another point for every dollar paid on those purchases. This means you can earn points quickly and efficiently as you shop.

Whenever you want to exchange your ThankYou® Points, you can redeem them for cash back as a statement credit, direct deposit, checks, and travel points. In addition, you can use points to purchase gift cards at Amazon or accumulate points to shop at different stores affiliated with this promotion.

For example, if you have accrued 1,000 ThankYou® Points, you can redeem them for $10. This redemption can be a statement credit to your account, a physical check, or a direct deposit into a recipient’s bank account.

Whatever method you choose, the value of your points remains the same, as they do not have an expiration date as long as the account is open and in use. The points will expire if the bank account is closed or switched to another account. In this case, the cardholder will have up to 60 days to use the points; otherwise, they will be forfeited.

@matthew..perry Citi Double Cash Card Review #NoNuanceNovember #WorkingAtHome #creditcardtips #credit #personalfinance #creditcards #fyp #foryou #citbank

As in every contract, there is the fine print, and this Citi Card Double Cash promotion is no exception, as there are transfers that will not earn any points. These are:

- Balance transfers.

- Cash advances.

- Checks accessing Your Card Account.

- Citi® Flex Loans.

- Foreign currency purchases.

- Fraudulent transactions.

- Items returned for credit.

- Loads or reloads of balances on prepaid or gift cards.

- Lottery tickets, gaming chips, and transactions made for betting purposes.

- Money orders.

- Other card account fees for services or benefit programs.

- Person-to-person payments.

- The creation of Citi Flex Pays.

- Traveler’s checks.

- Unauthorized or disputed purchases.

- Wire transfers.