When we open accounts at a bank or request cards or other resources, we start a history that can allow us to obtain different types of benefits. However, even though it doesn’t directly affect your credit score, opening accounts and having a positive relationship with your bank can improve your chances of gaining access to credit.

What does it mean to have a good relationship? These are positive actions that show the institution that you are a trustworthy person.

If you are unsure whether or not you are on good terms with your bank, here’s a guide with good practices that can help you strengthen this relationship.

Why is it important?

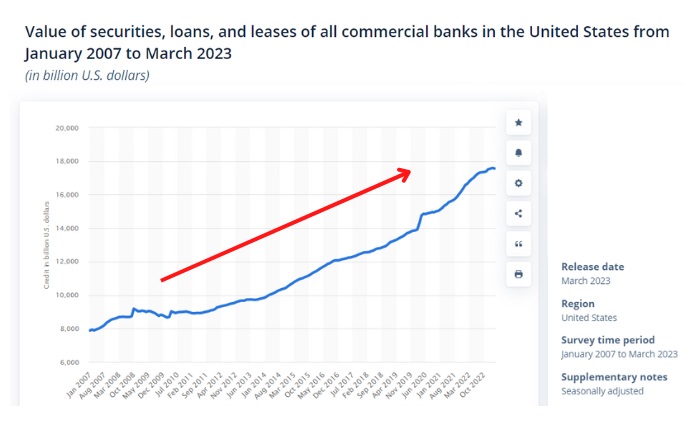

According to Statista.com, Commercial Banks credits in the United States have sharply risen over the past five years; it remains a useful resource for most Americans today.

However, this also means that there is a greater filter when choosing who has access to this benefit. That’s why building a good relationship with your bank is essential right now.

They will always prefer clients who are responsible and who know how to manage their resources. Most of them can ask you to close your accounts if you don’t.

So, when you demonstrate financial responsibility and good resource management, the bank can see this positively and it would influence their decision when evaluating your credit application.

Some other benefits that you can get are:

Access to privileged or VIP information

When you demonstrate a good record, the bank is more likely to share information with you about available financial products or services, including credit options that fit your profile and needs.

Also, they can include you in VIP lists to share gifts, presents, discounts with other brands, among other things.

Better conditions and interest rates

Although you will surely have the same conditions as other people at first, another benefit of having a good relationship with your bank is that they can give you access to better credit conditions and more competitive interest rates than other places.

Banks generally value their users’ responsibility, which is why they are willing to increase their loyalty by giving rewards like better contracts.

Faster application processes

If you already have a good financial history with the bank (through the proper use of cards, account maintenance, etc.), your application process to get a new credit can be expedited.

The bank manages this information and knows who meets their credit requirements and is also trustworthy. This may result in a faster evaluation of your application and a quicker response from the bank.

In some cases, you don’t even have to apply yourself; the bank may contact you and let you know that you meet their criteria for credit.

Good practices to strengthen your relationship with the bank

Although these small actions seem obvious, they can give you an advantage when applying for a loan or credit.

And, although it may not be something you need at the moment, it is still advisable to improve your financial history for the future and thus be prepared.

Keep an active account

Make sure your account is regularly active. Make transfers, deposits, utility payments, etc. If you don’t use your account for a longer period of time, the bank may consider this as a low commitment.

However, do not overdo it by moving money from your account excessively. Some banks may consider it suspicious if you receive or send large sums of money that do not qualify with your account type, monthly income, or expenses.

Comply with your financial obligations

Try as much as possible to pay your credits and bills on time, without delays. This is one of the most essential factors in demonstrating responsibility.

Also, it is important to remember that you should not apply for loans that you cannot repay. Be honest with your ability to pay so you can fully meet these obligations.

Use the additional services of the bank

To demonstrate loyalty, consider taking advantage of other services offered by your bank, such as credit cards (if you don’t have one yet), savings accounts, insurance, etc.

Keep your communication open

Make sure your contact information is always up-to-date and maintain open and transparent communication with the bank, either when they contact you or vice versa.

Also, remember that even if you have not been offered the possibility to get a credit, you can still ask to speak with an account executive or advisor to discuss your financial needs.

When should I start improving my financial history?

From the moment you open an account with the bank, you will already start your financial history with them. It is up to you to carry out positive actions.

Even if you only have a debit or savings account, it is advisable to establish a good relationship with your bank from the beginning since all of this will be taken into account to obtain a new card or greater credit.

Don’t wait until you need it; start now.

References

- How do I get and keep a good credit score. (2023, June 1st). In Consumer Financial Protection Bureau. https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-and-keep-a-good-credit-score-en-318/

- Value of securities, loans, and leases of all commercial banks in the United States from January 2007 to March 2024. (2023, June 1st). In Statista. https://www.statista.com/statistics/214283/bank-credit-of-all-commercial-banks-in-the-united-states-monthly/