Child support is a topic that often generates confusion and questions, especially when it comes to its classification as income. Many people wonder whether child support payments are considered income for various purposes, such as taxes or eligibility for government assistance programs.

Now, in most cases, child support is not considered income to the person receiving it and cannot be deducted as a tax deduction for the person paying it. It is not additional income for the recipient, but a legal obligation for the noncustodial parent.

Does Child Support Count as Income for VA Disability?

A common concern among veterans receiving VA disability pension benefits is whether the pension counts as income for calculating child support benefits. The answer is clear: VA disability pension benefits are not considered income for child support calculations.

Generally, child support is determined based on the noncustodial parent’s income and other relevant factors, but VA disability pension benefits are exempt from this calculation.

Does Child Support Count as Income for SNAP?

The Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps, is designed to help low-income individuals and families afford nutritious food. When it comes to determining SNAP eligibility, child support is generally not considered as income.

Instead, the focus is primarily on the income of household members, such as income from employment or self-employment. Therefore, if you receive child support, it should not affect your eligibility for SNAP benefits.

What is Child Support Used For?

Child support plays a vital role in ensuring the well-being of children in separated or divorced families. Funds received through child support are intended to cover various expenses related to raising a child. Among what is covered by child support are the following:

- Necessities: Child support helps cover the costs of food, clothing and housing for the child.

- Education: Contributes to school expenses, books, uniforms and other educational expenses.

- Medical care: Child support can help pay for medical and dental care expenses, including insurance premiums and co-payments.

- Child Care: Helps cover the costs of child care or babysitting services while the custodial parent works or attends school.

- Extracurricular activities: Child support can fund extracurricular activities such as sports, music lessons or art classes, providing the child with opportunities for personal growth and development.

It is also essential to remember that child support can be modified if there are significant changes in the circumstances of the parents or the child. For example, if the parent paying support experiences a significant reduction in income due to job loss, they may request a review of the amount they are required to pay.

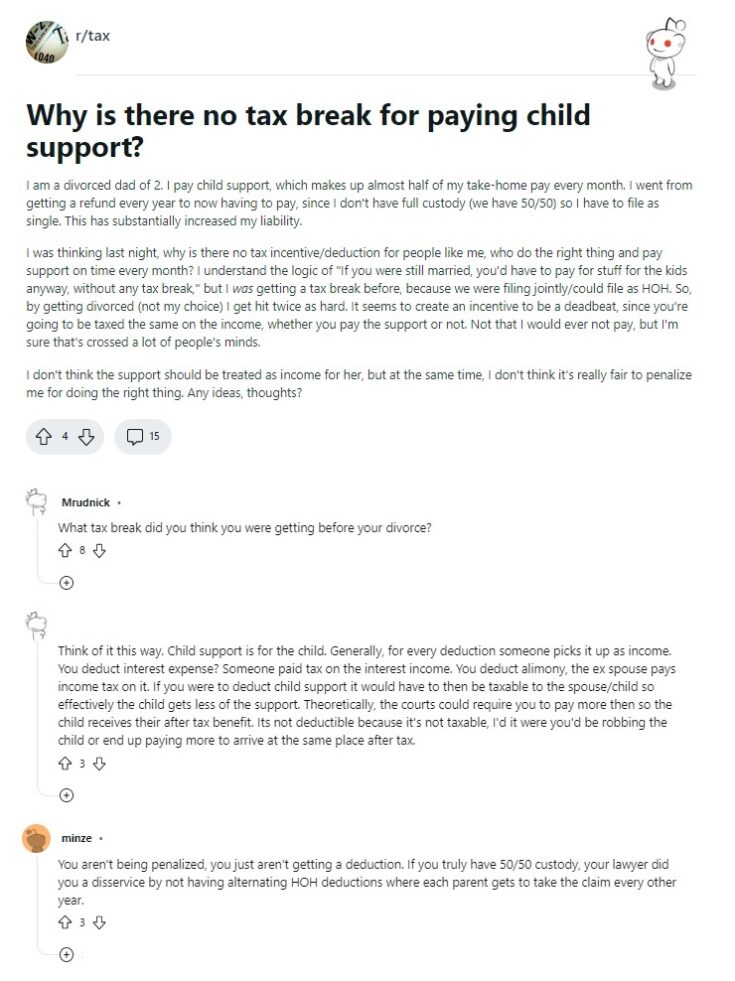

Is Child Support Tax Deductible?

The tax implications of child support payments are another area that often causes confusion. To clarify, it is not tax deductible for the parent making the payments, nor is it considered taxable income for the parent receiving it.

Unlike alimony, which may be tax deductible for the payer and taxable for the recipient, child support is treated differently from a tax standpoint.

It is critical to follow the guidelines and regulations established by local laws and the courts to ensure a fair and equitable distribution of resources. Child support is not considered income for purposes such as VA disability pension benefits or SNAP eligibility.

What is the maximum amount of child support that can be ordered by the courts in the United States?

In general, the calculation of child support in the United States is based on factors such as the parent’s income, the number of children and the children’s needs. Most states use standardized guidelines to calculate the amount of child support, and these guidelines may vary from state to state.

It is important to note that courts consider the financial ability of both parents when determining the amount of child support. The main idea is to ensure that the child receives adequate financial support to meet their basic needs.

Remember that each situation is unique and may be subject to different laws and regulations. It is always advisable to seek legal and professional advice to obtain accurate and up-to-date information about your specific situation.

What Happens If Child Support Is Not Paid?

The custodial parent may seek legal action to enforce payment, the courts may impose sanctions and order income withholding or garnishment of the non-compliant parent’s assets.

It is essential to meet child support obligations to avoid these consequences. Its purpose is to provide financial support to meet the basic needs of children in situations of separation or divorce.

Understanding these aspects of child support is crucial for both the paying and receiving parents to meet their financial responsibilities and ensure the best interests of the child. That way, you will know what happens when the child support is paid in full, and there will be no downside.

References

-

“Data | The Administration for Children and Families.” Welcome To ACF | The Administration for Children and Families, https://www.acf.hhs.gov/css/data.

-

“Interest, Dividends, Other Types of Income | Internal Revenue Service.” Internal Revenue Service | An Official Website of the United States Government, https://www.irs.gov/faqs/interest-dividends-other-types-of-income.