USAA Bank customers who want to transact from their accounts need an identification code. Still, this bank does not have its own code since it is a bank that does not have physical branches, but they are made electronically.

The USAA Bank code depends on the type of transfer being made, whether it is a transfer between accounts, through Zelle or Wire. Transactions to different banks will have an additional fee and will take longer to confirm. Still, USAA Banks is an excellent option to send and receive money and control your finances.

What is USAA Bank?

USAA (United Services Automobile Association) Bank is a financial institution that offers a wide range of banking and financial services, primarily to current and former members of the U.S. military and their families. It was founded in 1922 by a group of U.S. Army officers who wanted to self-insure their vehicles. It has since expanded its offerings to include banking, insurance, investments, retirement planning, and other financial products and services.

USAA Bank operates as a direct bank, meaning it has no physical branches, but conducts business online, by phone, and through mobile banking. USAA Bank is known for its focus on serving the military community and providing financial solutions tailored to meet their unique needs.

How do I know my USAA bank identification code?

USAA Bank does not have a specific bank code, such as a routing number or SWIFT code, like traditional banks. As a direct bank, USAA Bank does not operate with physical branches and typically does not require routing numbers or SWIFT codes for domestic or international transfers.

Instead, USAA Bank uses an internal system to facilitate transfers between USAA accounts. Members can transfer funds between their USAA accounts using their website or mobile app or by calling USAA customer service.

Suppose you must transfer from your USAA account to another bank or financial institution. In that case, you typically provide the routing number of the recipient bank, which is a nine-digit code used for domestic transfers within the United States.

NOTE: SWIFT codes, also known as Bank Identifier Codes (BIC), are used for international transfers and can typically be obtained from the recipient bank or found through online search tools.

Where can I find my USAA Bank code?

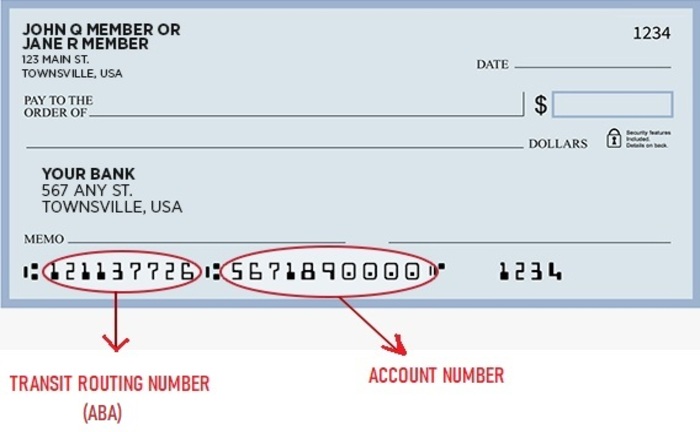

You can find your USAA Bank routing number by logging into your USAA account online, through your mobile app, or by contacting USAA customer service. You can find USAA Bank’s routing number at the bottom of your checks, usually located to the left of your account number.

What is the transit routing number or ABA for USAA FSB (Federal Savings Bank)?

The American Bankers Association (ABA) transit routing number is 314074269 for USAA FSB.

How to send money from USAA Bank to other banks

There are several methods to make online transfers from USAA Bank to other banks, so the customer can choose the one that suits them best.

Send money with Zelle®

To send money to friends or family with a U.S. bank account, you need their U.S. phone number or email address and log in to the mobile app.

Sending money through Zelle® must be done to customers enrolled in this electronic payment App, who will receive the money within a couple of minutes. If the recipient is not registered in Zelle, their money will arrive once they enroll.

Sending limits vary depending on how many payments are made:

- $1,000 or 3 payments per 1 day.

- $2,500 or 21 payments per 7 days.

- $10,000 or 90 payments per 30 days.

Transfers from one account to another

To transfer from a USAA FSB account to an account at another bank, you can do it from the USAA Bank website in the “Activity” section or from the mobile application. To make a bank transfer from your checking or savings account, you must have the following information from the recipient, which will be requested to complete the transaction:

- The amount you wish to send.

- Recipient’s full name.

- Zip or Postal Code.

- Bank transit routing number.

- Bank account number.

Type of transfers:

- Transfer between USAA FSB accounts: If you make a transfer Monday through Friday before 9 p.m. Central Time, it will be deposited immediately. If you transfer on holidays or weekends, the money can only be withdrawn at ATMs.

- Transferring from USAA to another bank usually takes 1 to 3 business days to complete, as long as the other account is verified.

- Transfer from another bank to USAA: This can take up to 7 business days.

Transfer Limits:

- Between USAA FSB accounts: Any amount within the available balance.

- From USAA to another bank: Up to $5,000.

- From another bank to USAA: Up to $5,000 (restrictions may apply).

Make a Wire transfer

To send money inside or outside the U.S., an excellent option is to do it through wire transfers, which can be requested online, although if you need to send more than $10,000, you will have to order it by phone.

The money transfer between accounts within the United States is done the same day, while international transfers can take up to 15 business days. You can send up to $10,000 online. If you wish to transfer over $10,000, please call (800) 531-USAA (8722).

If you want to know more about how to make transfers with a USAA account or have any doubts about this type of transfer, please check our website for more information.

FAQ(S)

What services does USAA Bank offer?

USAA Bank offers services that include checking and savings accounts, credit cards, auto loans, mortgage loans, personal and student loans, insurance products (such as auto, home, life, and health insurance), investment and retirement accounts, and financial advice and planning.

How do I become a USAA customer?

To become a member of USAA and access its banking and financial services, you generally must be active or former military, a family member of a military member, or a cadet or midshipman at a U.S. military academy. USAA Bank is known for its customer service, competitive interest rates, and commitment to the military community.

References

- Bodine, Alicia. “Here’s Your USAA Routing Number | GOBankingRates.” GOBankingRates, GOBankingRates, 10 Mar. 2021, https://www.gobankingrates.com/banking/banks/usaa-routing-number/.

- “Enable Cookies | USAA | USAA.” Enable Cookies | USAA | USAA, https://www.usaa.com/inet/wc/online-transfers?wa_ref=pub_global_banking_transfer_funds.