Who wouldn’t love buying items with other people’s money? When you use credit cards, it is what happens. However, you then have to pay the money back in installments. One of the most famous credit cards is American Express, which has saved many people from trouble.

Credit cards work with a bureau responsible for recording payment history. In addition, it must evaluate debts, balances, approved credit limits, and if payments are up-to-date. Not all companies use the same bureau.

What bureau does AmEx pull?

Experian primarily reports American Express credit card credit reports. However, they sometimes work with other credit bureaus for their credit reports.

TransUnion produces reports for the AmEx MyCredit Guide, a free guide to their credit reports; as you can imagine, they also work together, as with Equifax.

How often does AmEx report to credit bureaus?

AmEx reports to the credit bureaus once a month and releases monthly statements. Therefore, if you pay the bill after you receive the information, you will have to wait until the next statement to see it reflected on your credit report.

How do credit bureaus work?

The three major credit bureaus in the United States are solely responsible for providing companies, organizations, or authorities with credit reports so that they can analyze the risks to which they are subject.

These companies’ profits come from selling credit information, which they have obtained free of charge from lenders, banks, and other data providers.

The algorithm used by the credit bureaus to analyze the data can vary from one bureau to another, as no two collect the same information about a consumer. The information differences happen for various reasons, so it is impossible to pinpoint which would be the most accurate.

However, most agencies rate credit based on FICO credit scores and usually rely on the same factors to determine credit for their users.

Personal Information

It consists of the user’s legal name, current and previous address, date of birth, Social Security number, and job title.

Public Information

The credit bureau will certainly keep track of the company’s financial events, such as liens or bankruptcies.

Account Behavior

Payment history is continually reviewed to evaluate credit cards, their balance, debts, approved credit limits, and whether they are current on payments.

On the other hand, as for the FICO credit score, this value may also differ from one agency to another, but generally, the differences are not huge. All agencies consider a good credit score to be between 670 and 739.

What credit cards does American Express offer?

The cards they offer are intended for both consumers and businesses. There is a long list of options, from luxury premium cards to cards with no annual fee.

In addition, they provide benefits to their loyal users because they have partnered with brands such as Marriott and Delta to design credit cards that reward hotels and airlines.

How can I get the AmEx MyCredit Guide?

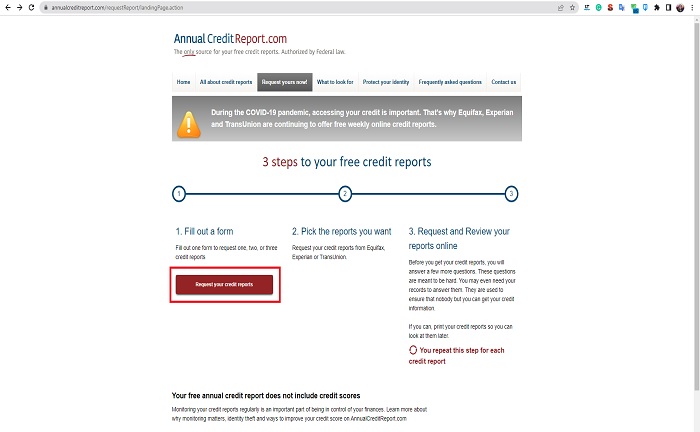

There are two ways to get a copy of the credit report, either through the website or by calling.

When you log into the free report request web page, you must select “Request your free credit reports” and then fill out the form.

On the other hand, to communicate, you only have to dial 1-877-322-8228.

Users have the lawful right to obtain at least one free credit report a year. This report must come from the three major credit reporting agencies: Experian, TransUnion, and Equifax.

Individuals with reports can obtain a weekly report through the end of 2022. The information can be requested either separately or together, regardless of the time frame.

Consumers can request them anytime they want or need them.

What information will I get when I download the AmEx MyCredit Guide?

This guide has all the information and tools regarding the TransUnion credit score, which help to understand the score better. When you log in, your score is updated weekly.

TransUnion’s detailed credit report contains information such as credit education articles, factors affecting the credit score, and score history. In addition, a score simulator called Credit Score Simulator helps to study the impact of potential financial decisions.

However, it is important to keep in mind that the results of the simulator are estimates, so it is not 100% certain that the impact it yields will occur. Finally, it sends emails about changes in credit information to identify possible fraud.

References

-

Crail, Chauncey. “What Credit Bureau Does American Express Use? – Forbes Advisor.” https://www.forbes.com/advisor/credit-cards/american-express-credit-bureau/