H&M’s products are recognized in many countries around the world. The Swedish company is recognized for the quality of its clothing and the retail prices it offers its customers. Like other stores, it provides a special credit card to make purchases in its stores.

Its stores operate in 71 different countries and serve more than 5,000 stores. It can only use its credit card in its stores, i.e., closed-loop. An online account is required to acquire the benefits.

H&M credit card application

As we highlighted before, it is a store card that can only use in one of their locations. Therefore, to apply for it, you need to go to one of the branches and ask the clerk for it.

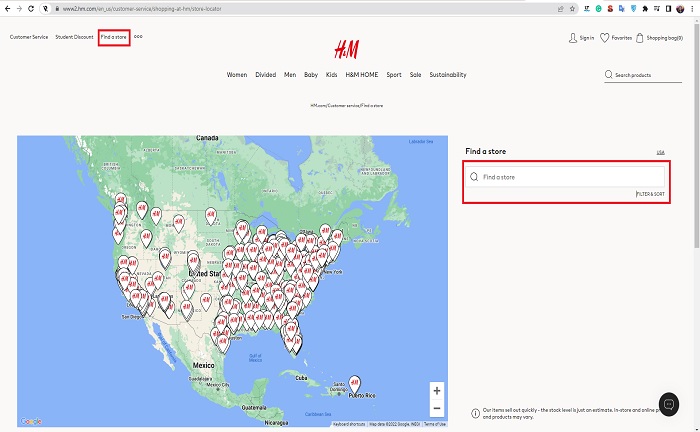

Through the online page, it is possible to know the other locations near your residence.

There is also the option to pay later through 855-466-7467. It is an alternative you can use as a credit card because you can make purchases and have time to pay the bills. Now, to apply for the H&M credit card, you need to meet some basic requirements, such as:

- Present a valid ID card issued by the government of your country

- You must be a citizen of the country where you are applying for the credit card or be a permanent resident

- Be at least 18 years old

As it is a store located in different countries worldwide, it is necessary to contact one of its branches to find out the particular requirements in each country.

How do I know if I am eligible?

Regardless of where you live, there are eligibility conditions for all users. It is necessary to provide a valid email address and a telephone number where the card reaches in case of problems.

In addition, you will be evaluated if you have a stable income to be responsible for the monthly payments for purchases. The history of bankruptcies or criminal records is also assessed to determine no such complications.

In case of outstanding debts, the card will not be approved until they are paid off and the credit history is improved.

Benefits of the credit card

After knowing the complications in acquiring it and the requirements that it must meet, you may wonder if it is worth it. The H&M credit card has several benefits:

- It awards 1 point for every dollar spent.

- All your returns are free when you want to return an item because it is not what you expected.

- After accepting the membership, you can enjoy a unique 10% discount.

- Membership events are exclusively for customers.

- Can view purchase receipts.

- You will enjoy birthday offers with your credit card.

Offers obtained with the H&M Credit Card

In addition to all the benefits mentioned above, there are also some additional offers for their credit card customers. Some prominent ones are:

Transaction Encryption

All data provided on the online site is fully protected. The data is encrypted as it is sent to ensure that everything is confidential and hassle-free.

You must go to H&M’s online page, “log in,” and enter the corresponding credentials. In this section, you will find the option “register” if you do not yet have an account.

You will be charged for the garments when the order is shipped

Nothing will be charged until the order is shipped. When the transaction is processed, the amount is reserved immediately, and you will receive an order confirmation email. It is certainly perfect because it is easier to return the goods.