Merrick Bank credit cards are designed for people looking to improve their credit or build it from scratch. Make sure to check and be careful about any additional fees while using them.

They are options with many benefits and drawbacks that you need to be aware of from the start. Their credit cards can be secured or unsecured depending on what the user needs.

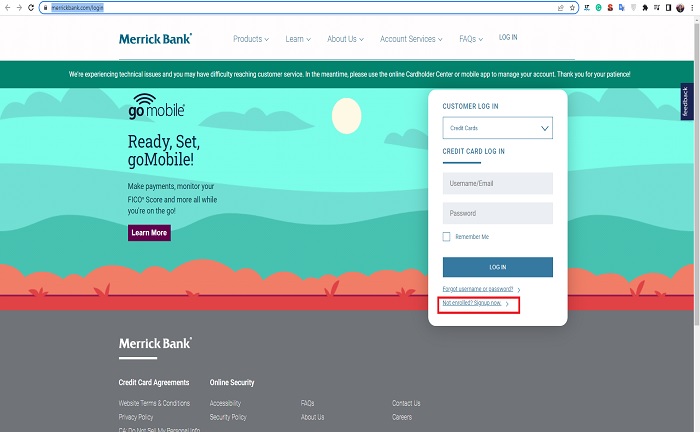

Merrick login credit card

To log in to the card account, you must go to the Merrick Bank website, and on the right side of the page, you will find the box meant for the credit card login.

If you are new to the service, go to the option under the “log in” button that says “not registered? Register now”.

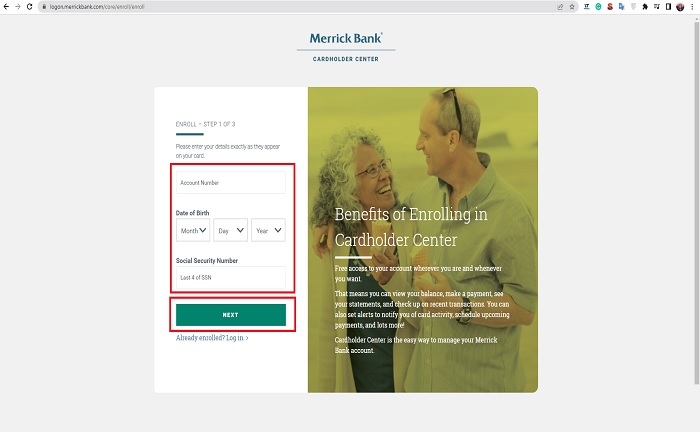

On the next page, you must enter your exact credit card information. The first requirements are the account number, the cardholder’s date of birth, and the last four Social Security digits. After confirming that all information is correct, “next” can be selected.

The basic data requested must be completed and a username and password created to complete the registration. Access is free and can be done anywhere you can access a secure internet connection.

When the registration is finished, you have to go back to the home page and log in with the credentials created.

How to pay with a credit card online?

Once you have your username and password, you only need to access your account from the home menu on the Merrick Bank website. You must locate the option “bill payments” on the main page. Here is the option to make the minimum payment, a little more than the minimum amount or the total amount of the debt.

It is necessary to add the payment methods with which the payments will be made and confirm the transaction when you ensure that all the data are correct. There is the alternative of activating automatic payments with debit, credit, checking or savings cards.

This way, there is no need to worry about being late because every month on the same date, the platform will automatically deduct the selected amount.

Payments by mail or telephone

Merrick Bank also offers the option to pay by phone by calling 1 – 800 – 204 – 5936 to speak with customer service. Can do this through the operator or by requesting to speak to one of the agents.

The second option usually has additional charges that are indicated before starting the process to ensure that the person agrees. On the other hand, checks and money orders are also part of the options.

Should send the payment envelope and credit card account number to Merrick Bank PO Box 660702 Dallas, TX 75266 – 0702.

Merrick Bank Credit Card Details

As we mentioned, it is a dedicated bank and has different credit cards available for its customers. The Merrick Bank Double, Your Line Secured Visa, is the one to go for when the customer has bad credit and is seeking an option to help improve it.

Part of the credit card details is that it reports to the three credit bureaus every month about your transactions. It allows you to access your FICO score, easily double your limit, and enjoys $0 fraud liability protection.

However, like most credit cards from this bank, the APR is higher than expected, and there are extra fees for foreign transactions. Each of their options has different advantages.

They all have attractive options to help you improve your credit and FICO score and access other benefits such as loans and credit for different purposes.