The Buckle is one of the most popular clothing retailers in the United States. It has a convenient credit card available to customers to bring its services to more people and with greater ease.

Although it does not have many rewards and benefits, it has been able to adapt to the needs of its customers from the time offered the card. It is ideal for those looking for a line of credit at Buckle.

Buckle payments

The payment alternatives are varied to suit the needs of each cardholder. There is a choice of online payment, payment by phone or pay by mail. All other options are available.

Online payment

Technology is taking over more and more processes every day, one of which is Buckle’s credit card bill payment. This option is ideal because it can be carried out by cell phone or computer. The important thing is to have a secure internet connection.

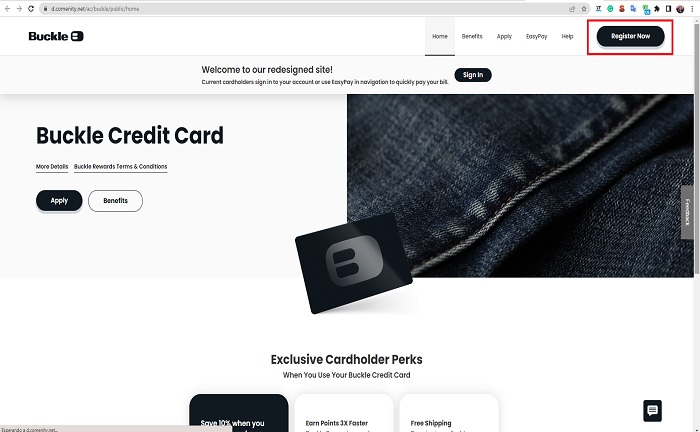

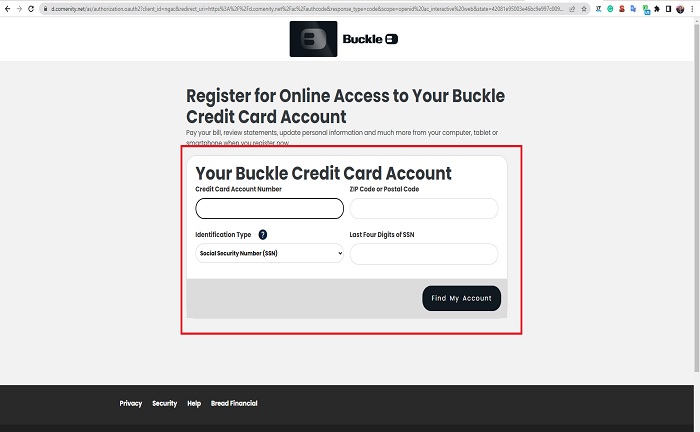

It is essential to pay outstanding bills to catch up on bill payments and continue to enjoy Buckle benefits. To do so, log in to the credit card website. For those who do not yet have an active account, the process is first, find the “Register now” option.

After confirming that all the information is correct, it is time to click “get my account” and fill the rest boxes with the information the platform requests. After confirming all the card data and validating them, it is time to create the username and password to access the account.

You will receive an email confirming the account, indicating that you must return to the home page to log in with the data created. Once inside the personal account, it is time to identify the option “invoices and payments” and click on it.

On the new page, add the amount to be paid and the bank account details from which you will deduct the amount due. It is essential to enter all the correct data and ensure that you have sufficient funds to cover the chosen amount.

Before processing the payment, there will be the alternative of automatic programming payments. A checking or savings account can be associated with this choice. It will also request the date on which it will make payments each week or month and the amount to be deducted at all times. Can select the minimum amount allowed here.

The service will take care of processing the information and send a message with the payment validation and invoice you can keep for your records. It is important to note that all payments made in this way before 6 p.m. are credited the same day.

Payment by phone

The most traditional payment is through a phone call following the steps dictated by the operator or service agent. At Buckle, you can call 1 – 888 – 427 – 7786 and complete the entire payment following the steps dictated by the system.

It is recommended to have the billing information and the bank account with which will make the payment to make the process secure and fast.

Payment by mail

Another alternative is to complete the invoice payment through a check or money order. These should be sent to Buckle Credit Card, PO Box 659704, San Antonio, TX 78265. It is also advisable to call customer service whenever a payment is sent to confirm that the address remains the same.

On the other hand, it is essential to include the account number on paychecks to process the payment. Remember that shipments should be made well in advance to ensure that they will arrive and be processed on time and the invoice will not be overdue.

Buckle Card Details

As mentioned, it is not a card with many benefits and rewards. When you purchase it, you enjoy a 10% discount on the first purchase made. You can sign up for the “B – Rewards” program and earn $10 for every $300 spent during the program’s eponymous period.

Spend more than $500 a year and receive the Black Buckle credit card for free shipping on domestic orders. And for purchases made during the birthday month, you receive 100 bonus points.

It has a 24.99% variable APR, and the minimum interest charge is $1. Like most of these cards, it has no annual fee.