The Pep Boys credit card is issued by Synchrony Bank, one of the most common providers of retail credit cards. With this product, you can access special interest-free financing for up to 12 months for car repairs.

This financing is available for repairs under $499. Although it is intended for vehicle repairs, we can also use it at the United States Mobil and Exxon service stations.

Pepboy credit card payment

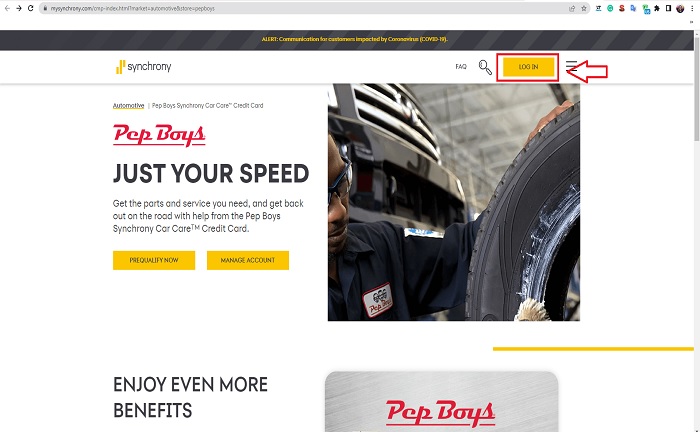

To pay for your Pepboy credit card, you must log in to the company’s online site and register to create your account. When the card is new, you can register to use their online services by going to the Pepboy website.

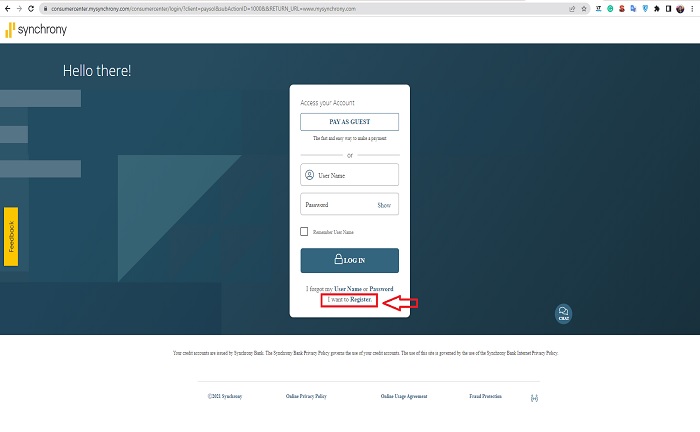

Once inside, go to the yellow “log in” button at the top right of the page. The login form and option “I want to register” are on the next page below.

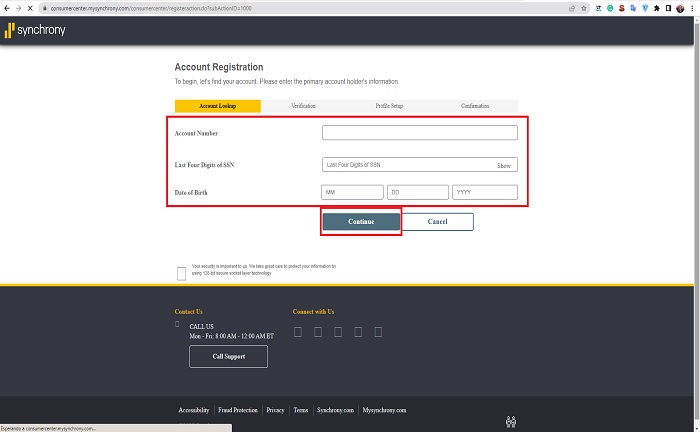

When you click “register,” the form for adding the account number and other card data will appear. It is necessary to verify all the data provided, set up the profile, and confirm it through the message received in the email.

When your registration is complete, it is time to log in to make payments, check your account status, transactions made, and other information related to your account.

You must return to the home page and log in with the username and password created; on the main page, you should find the option “make a payment” and add the amount to be paid. On this same page, you can select the option to schedule automatic payments so that the minimum amount is deducted from your current account every week or month.

All you need to do is include all the bank information such as account number, social security number, and email address. Remember to do a final verification of all the information before sending the payment.

Payments by phone or mail

Online options are still not the most pleasant for all users. Some do not trust these options or have limitations in accessing the Internet. In any case, there are always other alternatives to make Pepboy credit card payments.

Of the other options, the simplest and safest is through a phone call; before making a phone call, you must have your Pep Boys credit card, most recent invoice, and bank information, including routing number.

To contact customer service, you can call 1 – 866 -396 – 82 -54 and select the option to speak to a customer service agent or make the transaction through the automated system by carefully following the steps outlined.

Alternatively, if checks or money orders are the preferred choice, you should send them to Synchrony Financial P.O Box 960061 Orlando, Florida 32896 – 0061.

Benefits of the Pep Boys Credit Card

The initial mission of this card is to keep the cardholder’s car in good condition and allow for timely repairs, and the ability to save money.

To apply for the card, one must go to one of the nearby stores and fill in the corresponding form. One of its main benefits is the promotional financing offers with which you can make large payments without interest on the balance for a period determined by the company.

For expenses between $299 and $750, you enjoy six months. Now, when the expenses extend to more than $750, the interest-free term will be 12 months. Add to that the grace period available, which is 25 days for expenses less than $299.

It offers financing plans so you can make monthly payments without inconvenience. It is an efficient card to make unexpected repairs and buy accessories in any Pep Boys stores available in different areas of the country.

Discount coupons are also a viable alternative when opening an account, and you spend more than the amount stipulated by the company. Should note that for those with a small credit history, the credit limit of the card will be lower, being positioned at $500 in most cases.

In addition, there will be an interest rate of 25.00%. As a store card, cash advances or balance transfers are not available. To avoid inconveniences before acquiring the card, the terms and conditions that must be met are provided.

Finally, it is an adequate alternative when you need to cover unforeseen expenses generated by the card. But it is essential to ensure you can meet the card payments to avoid damaging your credit history.