Havertys is a furniture retailer that started in 1885 and today has at least 120 locations in different cities in the United States. Their credit card has the mission to offer you viable solutions for your purchases.

They have different furniture available for living rooms, dining rooms, bedrooms and other areas at home and in the company where you need it. Their credit card is issued by Synchrony Bank, which indicates a high-quality product.

How to make Havertys credit card payments?

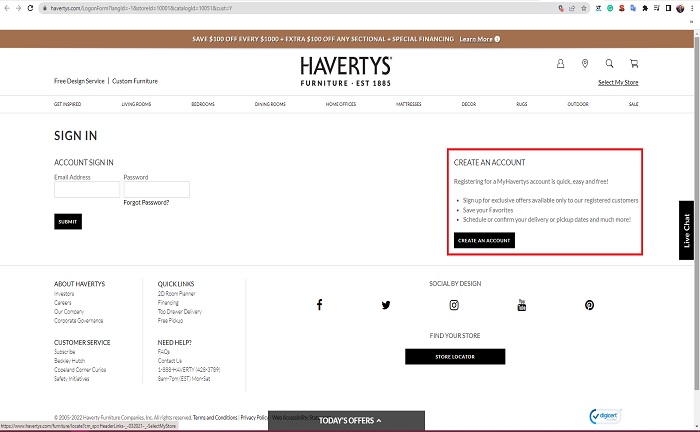

The fastest and most common way to make your credit card payment is through Havertys’ online page. When you go to the login option, on one side, you will see “create an account” when you press the button, the form necessary to create the account will appear effectively.

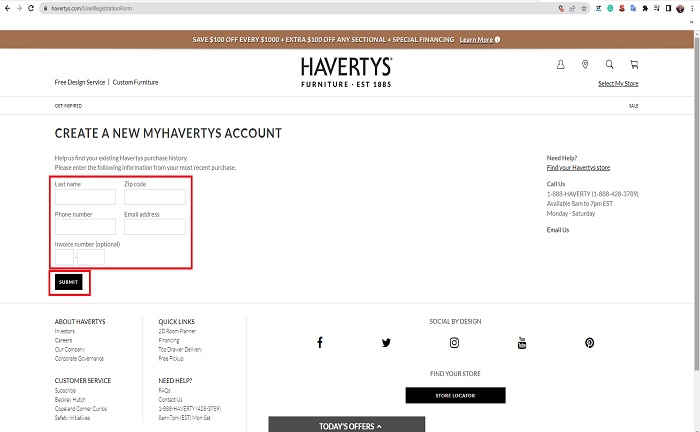

It asks for name, zip code, e-mail address, and telephone number. Once all the corresponding data has been included, and the user and password have been created, it is necessary to return to the login and enter the platform with the credentials obtained.

Once inside, go to the “payment” tab and add the amount to be paid, either the minimum amount or the total amount of the current debt. To continue, you must enter the bank account information from which the funds for the payment will be taken and the Havertys credit card information to be paid.

Through this option, you can also set up automatic payments to ensure that the corresponding payments are not delayed before the due dates, and you will avoid late payment interest.

Payments via a phone call or postal mail

All users do not prefer digital options; some prefer traditional alternatives. One of the most effective is to call customer service numbers. To contact Havertys, you need to call 1 -844 – 335 – 5909 and speak to one of the agents.

Your credit card and savings account details are usually required to pay the bill. Hours of operation are Monday through Sunday from 7:30 a.m. to 12 noon.

On the other hand, should send postal payments to Synchrony Financial, PO BOX 960061, Orlando, FL 32896 – 0061. It is essential to send checks or money orders plenty of time to avoid having them arrive after the due date and incur late fees.

Late Payment Fees and Interest Rates

The credit card offered by Havertys enjoys an APR of 29.99% and a minimum interest charge of 2%, similar to most cards available in the country. The company also considers late payment fees, which can be up to $38.

The late payment fee depends on different factors, either because you did not make the payment at the proper time or it was mailed and did not arrive on the appropriate date due to a late payment.

Regardless of the case, you should ensure that it is not a constant occurrence and avoid it every month. Not only because of the additional payment charge, but it will also affect your credit score.

Is this credit card profitable?

The mission of the credit card is to provide customers with the purchasing power needed to make large purchases at Haverty’s. It is not a service that includes any special financing offer. On the contrary, periodically, the store discloses new special financing plans available to cardholders.

They have a zero interest offer for the first 18 months on purchases over $2,000. If the rule of paying in full within 18 months is not met, the established interest rate of 29.99% will be applied to the total balance from the date of purchase.

Therefore, it is recommended that before applying for the card, all the terms and conditions of the credit card be evaluated.